Managing payroll can feel like a mountain to climb, especially for small business owners or freelancers. Between taxes, paychecks, and compliance, it can all get overwhelming. That’s why I’m excited to share this detailed Wave Payroll Review – a solution that simplifies payroll tasks without burning a hole in your pocket.

If you’re here, you’re likely wondering: Is Wave Payroll the right fit for my business? In this review, I’ll walk you through everything you need to know – its features, pricing, pros, and cons, and even how it compares to competitors. Let’s get started!

Table of Contents

ToggleWhat is Wave Payroll?

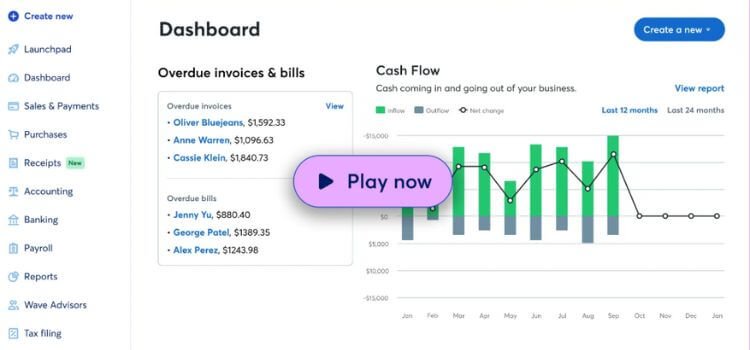

Wave Payroll is an affordable payroll service designed for small businesses and freelancers. It’s part of the Wave suite, which includes accounting and invoicing tools. Founded in 2010, Wave aims to provide cost-effective, easy-to-use financial solutions.

With Wave Payroll, you can automate tax filings, pay employees directly, and manage payroll reports all in one place. It’s particularly popular among businesses with fewer than 10 employees.

You May Also Read This: Gusto vs SurePayroll

Key Features of Wave Payroll

Let’s break down the features that make Wave Payroll stand out:

Automatic Tax Filing

Wave handles your federal, state, and local payroll taxes. It takes care of quarterly filings, annual forms, and compliance requirements. For example, if you’re in Texas or California, Wave ensures all tax laws are followed, so you don’t have to worry about penalties.

I once used another software that missed a state tax deadline. It cost me $300 in fines! With Wave Payroll, I don’t lose sleep over tax compliance.

Direct Deposit and Employee Self-Service

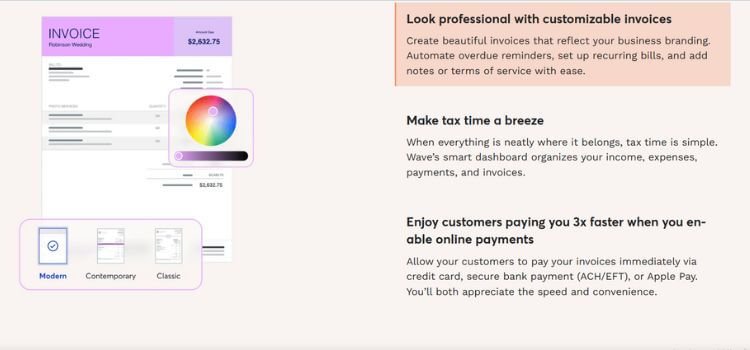

Say goodbye to paper checks! Wave allows you to pay employees via direct deposit. Employees can also access their pay stubs and tax forms online, saving everyone’s time.

Imagine how happy your employees will be when payday is always on time – no hassle, no waiting!

Payroll Reports

Wave provides detailed payroll reports, covering payroll costs, tax liabilities, and employee earnings. These reports are handy for financial planning and tax preparation.

Businesses that use payroll reporting tools are 40% more likely to stay within budget.

Integration with Wave Accounting

Wave Payroll seamlessly integrates with Wave Accounting, creating a unified financial management platform. All payroll expenses automatically sync with your books.

User-Friendly Interface

Wave Payroll is designed for simplicity. You don’t need to be tech-savvy to set it up. From signing up to running payroll, the steps are clear and quick.

Mobile App

With the Wave mobile app, you can manage payroll on the go. It’s perfect for entrepreneurs who wear multiple hats.

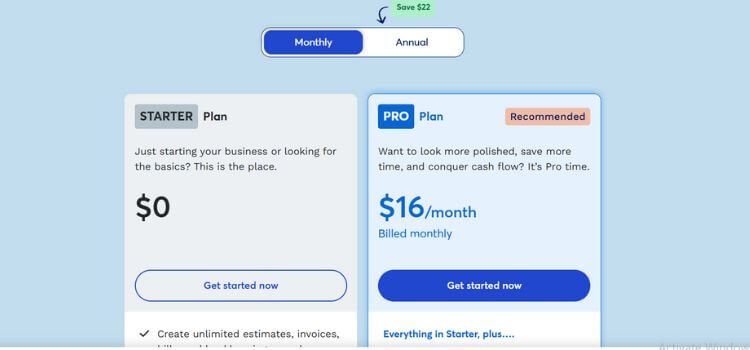

Pricing

Wave Payroll offers straightforward and competitive pricing:

| Plan | Monthly Fee | Per Employee Fee | Features |

|---|---|---|---|

| Tax Service States | $40 | $6 per employee | Includes tax filing and compliance. |

| Self-Service States | $20 | $6 per employee | Excludes tax filing. |

There are no long-term contracts, so you can cancel anytime.

Wave Payroll is one of the few services with such transparent pricing. Many competitors charge hidden fees!

Pros and Cons of Wave Payroll

Pros

- Affordable: Perfect for businesses on a budget.

- Easy to Use: No steep learning curve.

- Automatic Tax Filings: Saves time and reduces errors.

- Integration: Works well with Wave Accounting.

- No Contracts: Flexibility to cancel anytime.

Cons

- Limited Features: Not suitable for larger businesses or those needing advanced HR tools.

- No Phone Support: Only email support is available, which might be slow for urgent issues.

- State Restrictions: Tax filing is not available in all states.

Setting Up Wave Payroll

Setting up Wave Payroll is a breeze. Here’s a step-by-step guide:

- Sign Up: Visit the Wave Payroll website and create an account.

- Business Info: Enter details like your business name, EIN, and address.

- Add Employees: Input employee names, salaries, and payment methods.

- Set Pay Schedule: Choose how often you’ll pay employees (weekly, bi-weekly, etc.).

- Connect Bank Account: Link your bank to fund payroll.

And that’s it! You’re ready to run your first payroll.

Competitor Comparison

How does Wave Payroll stack up against its competitors? Let’s compare:

| Feature | Wave Payroll | QuickBooks Payroll | Gusto |

| Pricing (Base) | $20-$40/month | $30/month | $40/month |

| Automatic Tax Filing | Yes | Yes | Yes |

| HR Features | No | Limited | Comprehensive |

| Free Plan | No | No | No |

If you need advanced HR tools, Gusto might be better. But for affordable, basic payroll, Wave is unbeatable.

Who Should Use Wave Payroll?

Wave Payroll is ideal for:

- Small Business Owners: Especially those with fewer than 10 employees.

- Freelancers: Who occasionally hire contractors.

- Budget-Conscious Entrepreneurs: Looking for an affordable option without sacrificing quality.

When I first tried Wave Payroll, I was managing a small team of five. Taxes used to give me headaches, and I dreaded payday. Wave changed that. The interface was so easy that I felt like a pro within minutes. And knowing that taxes were being handled automatically? That was a game-changer.

Do you think an affordable, user-friendly payroll system like Wave could make your life easier?

FAQs About Wave Payroll

Can I use Wave Payroll for contractors?

Yes, Wave allows you to pay contractors with ease.

Is Wave Payroll available outside the US?

Unfortunately, it’s only available in the US and Canada.

What if I have issues with the software?

Wave offers email support and a comprehensive help center.

Can I customize the pay schedule?

Yes, you can set pay schedules to weekly, bi-weekly, monthly, or custom intervals to suit your business needs.

Does Wave Payroll integrate with other tools besides Wave Accounting?

Currently, Wave Payroll primarily integrates with Wave Accounting, but you can export reports for use with other systems.

Conclusion

Wave Payroll is an excellent choice for small businesses and freelancers. It’s affordable, easy to use, and handles the heavy lifting of payroll management. While it’s not ideal for large businesses or those needing advanced HR tools, it’s a perfect fit for entrepreneurs on a budget.

Imagine the peace of mind you’ll have when taxes, paychecks, and compliance are no longer your worries!

If you’re ready to streamline your payroll, why not give Wave a try today? It could be the best decision you make for your business in 2025.

This post contains affiliate links. I may earn a commission if you make a purchase through them, at no extra cost to you.