When I first started looking for payroll solutions, I quickly realized how overwhelming it can be. There are so many options out there, but one name kept coming up—ADP Payroll. If you’ve ever wondered, “How much does ADP Payroll cost?” you’re not alone. I’ve done the research to help make sense of it all. ADP is a trusted name in payroll services, but understanding its pricing and whether it’s the right fit for your business is key.

ADP has a long history of providing reliable services. With its flexible plans and tailored features, it has become a go-to for businesses ranging from small startups to multinational corporations. By the end of this guide, you’ll have a clearer idea of what to expect when considering ADP for your payroll needs.

Table of Contents

ToggleWhy Should You Care About Payroll Costs?

If you run a business, payroll isn’t just another task. It’s the lifeline that keeps your employees happy and your business compliant with tax laws. Choosing the right payroll system is like choosing the foundation for your house—it needs to be solid, reliable, and worth the investment.

Payroll errors can be costly, not just financially but also in terms of employee trust. Imagine the impact of a missed paycheck or incorrect tax filing. These issues can snowball into larger problems, including legal troubles. That’s why understanding payroll costs and investing in a dependable system like ADP is crucial.

A well-structured payroll system doesn’t just save you time; it also reduces stress. Instead of scrambling to meet deadlines or fix errors, you can focus on growing your business. So, let’s dive into why ADP might be the solution you’re looking for.

What Is ADP Payroll?

ADP (Automatic Data Processing) is a well-known name in payroll and HR services. Since its start in 1949, ADP has grown to help businesses of all sizes. Whether you’re running a small startup or managing a large multinational company, ADP has solutions to handle payroll, taxes, and HR needs.

Over the decades, ADP has built a reputation for reliability and innovation. It offers cloud-based solutions, ensuring that you can access your payroll data anytime, anywhere. ADP also keeps up with the latest compliance regulations, so you don’t have to worry about staying updated on ever-changing tax laws.

ADP isn’t just about payroll. It also offers HR tools, time tracking, and benefits management. This makes it a one-stop shop for businesses looking to streamline their operations. Whether you’re a startup or a large enterprise, ADP’s customizable plans can cater to your unique needs.

You May Read Also: How Much Does SurePayroll Cost?

ADP Payroll Plans

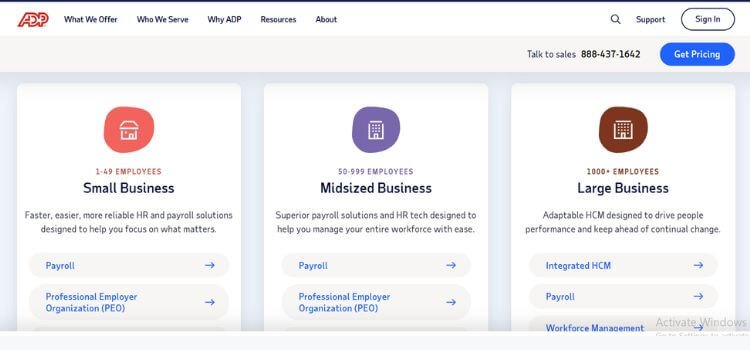

ADP offers different payroll plans based on the size of your business and its needs. Here’s a quick breakdown:

| Plan | Best For | Features |

|---|---|---|

| Essential Edition | Small businesses | Direct deposit, tax filing, new hire paperwork |

| Standard Edition | Growing businesses | All Essential features + onboarding and expense tracking |

| Advanced Edition | Established businesses | All Standard features + analytics, recruitment tools, and HR helpdesk |

| Global Solutions | Multinational corporations | All Advanced features + multicurrency payroll and multinational compliance |

The Essential Edition is great for startups. It includes basic features like direct deposit and tax filing. As your business grows, you might need the Standard Edition, which adds onboarding and expense tracking. For established companies, the Advanced Edition offers powerful analytics and HR tools. Multinational corporations can benefit from the Global Solutions plan, which handles complex payroll needs across multiple countries and currencies.

Each plan is designed to cater to specific business needs, ensuring you only pay for what you use. This flexibility makes ADP a popular choice among businesses worldwide.

What Influences ADP Payroll Costs?

ADP’s pricing isn’t listed publicly. Instead, it’s customized based on several factors:

- Number of Employees: The more employees you have, the higher the cost.

- Features Needed: Basic plans cost less; advanced plans with HR tools cost more.

- Frequency of Payroll Runs: Weekly payrolls are more expensive than monthly ones.

- Add-Ons: Extra services like time tracking or recruitment tools will increase the price.

For instance, a company with 50 employees will naturally pay more than a company with 10 employees. However, the cost per employee may decrease as your workforce grows, offering economies of scale. Similarly, if you need advanced analytics or global compliance tools, expect the price to go up.

Weekly payroll runs can add to the cost since they require more frequent processing. Additionally, add-ons like time tracking, benefits management, or recruitment tools can significantly influence your final bill. Understanding these factors can help you negotiate a better deal with ADP.

Estimated Costs

Though ADP doesn’t provide specific prices upfront, here’s an estimate based on industry feedback:

| Business Type | Estimated Cost | Details |

|---|---|---|

| Small Businesses | $150–$200 per month | For 10 employees, covers basic payroll functions like direct deposit and tax filing. |

| Medium Businesses | $200–$500 per month | Costs depend on features like onboarding, expense tracking, and HR support. |

| Large Businesses | $500+ per month | Especially for multinational solutions, including multicurrency payroll and compliance tools. |

For example, my friend’s company (with 15 employees) uses the Standard Edition. They pay around $250 per month, including onboarding tools and HR support. While this might seem steep, the time saved on payroll processing and compliance makes it worthwhile.

If you’re a small business owner, you might find the Essential Edition sufficient. Medium-sized businesses often opt for the Standard Edition to get additional HR support. For large corporations, the Advanced or Global Solutions plans are ideal for handling complex needs. Corporations, the Advanced or Global Solutions plans are ideal for handling complex needs.

Why ADP?

ADP is trusted by millions of businesses worldwide. It’s reliable, secure, and comes with expert support. If you’ve ever stayed awake worrying about tax compliance, ADP could save you from countless headaches.

Key Benefits:

- Time-Saving: Automates payroll and tax filing.

- Accuracy: Reduces errors with automated systems.

- Support: 24/7 customer service for peace of mind.

ADP also integrates seamlessly with other tools you might already be using, like accounting or HR software. This reduces the learning curve and makes implementation smoother. Its cloud-based platform ensures that you can manage payroll even when you’re on the go.

However, no system is perfect. ADP’s lack of upfront pricing can be frustrating, especially for small businesses on a tight budget. Some users also report that the interface could be more intuitive. But these drawbacks are outweighed by its robust features and support.

How Does ADP Compare to Competitors?

Here’s a quick comparison with other payroll providers:

| Provider | Starting Price | Best Feature | Drawback |

| ADP | Bespoke | Full-service solutions | No upfront pricing |

| Gusto | $40/month | Easy-to-use interface | Limited global payroll options |

| Moorepay | Bespoke | UK-focused payroll | No support for global growth |

| 1-2-Cloud | £5/month | Budget-friendly for small biz | Limited scalability |

ADP stands out for its comprehensive features and global reach. Gusto is a great alternative for small businesses looking for simplicity and affordability. Moorepay focuses on UK-based businesses, while 1-2-Cloud is ideal for very small companies with basic payroll needs. Your choice will depend on your specific requirements and budget.

Is ADP Worth It?

This depends on your business size and needs. For small startups, ADP’s Essential Edition offers core payroll tools to keep things running smoothly. For growing businesses, the Standard or Advanced plans provide added features like analytics and HR support.

For multinational companies, ADP’s GlobalView plan is hard to beat. Imagine having one system to handle payroll for employees in different countries—it’s a game-changer.

While ADP might seem expensive at first glance, its value lies in the time and stress it saves. Accurate payroll and compliance are priceless when you consider the potential penalties for errors. Plus, its scalable plans mean you can start small and grow as needed.

Tips For Using ADP

From my own experience working with payroll systems:

- Start Small: If you’re new to payroll, start with a basic plan. You can always upgrade as your needs grow.

- Ask Questions: When talking to ADP, don’t shy away from asking for a detailed breakdown of costs.

- Take a Test Run: Request a demo to see if ADP’s interface works for you.

Do you think ADP’s features could save you time and stress? It’s worth considering if you’re ready to streamline your payroll process. Remember, investing in a reliable payroll system is an investment in your business’s future.

FAQs

How much does ADP Payroll cost for small businesses?

ADP’s pricing for small businesses typically starts around $150–$200 per month for 10 employees. Costs may vary depending on the features and services required.

What is included in ADP’s Essential Edition?

The Essential Edition includes direct deposit, tax filing, new hire paperwork, and a secure employee portal. It is ideal for small businesses with basic payroll needs.

Does ADP offer global payroll solutions?

Yes, ADP offers Global Solutions, which include multicurrency payroll, multinational compliance tools, and support for employees across multiple countries.

Can I customize ADP Payroll to fit my business needs?

Absolutely! ADP’s plans are highly customizable, allowing businesses to add features like time tracking, HR tools, and recruitment solutions based on their requirements.

Is there a free trial available for ADP Payroll?

ADP does not typically offer a free trial. However, you can request a demo to explore its features and see if it’s a good fit for your business.

Final Thoughts

ADP Payroll is a powerhouse solution for businesses of all sizes. While the costs are bespoke, the range of features and support make it worth the investment for many companies.

Whether you’re a startup with a small team or a multinational giant, ADP has something for everyone. And let’s face it—the peace of mind that comes with accurate payroll and tax compliance is priceless.

So, what do you think? Does ADP sound like the right fit for your business? Let me know if you’ve tried it or if you have any questions. I’m here to help!

This post contains affiliate links. I may earn a commission if you make a purchase through them, at no extra cost to you.