As a business owner, managing payroll can sometimes feel like walking a tightrope. That’s where the Best Payroll Funding Companies come into play. I’ve been there—waiting for client payments to come in while still needing to pay my team on time. It’s a stressful situation, but having the right payroll funding company can ease that burden. These companies offer quick, flexible funding to cover payroll gaps, so I can focus on running my business without worrying about cash flow.

In my experience, choosing the best payroll funding company is crucial to maintaining employee satisfaction and avoiding late payment fees. In this article, I’ll walk you through some of the best options available, based on factors like reliability, fees, and customer service. By the end, you’ll have a better idea of which company might be the best fit for your payroll needs.

Table of Contents

ToggleWhat Are Payroll Funding Companies?

Payroll funding companies help businesses pay employees when cash flow is low. They provide short-term loans or advance money based on unpaid invoices. This service is especially useful for small businesses, staffing agencies, and seasonal companies.

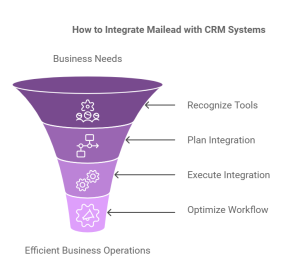

How payroll funding works:

- Apply for Funding: Businesses apply online and provide financial information.

- Get Approved Quickly: Most companies approve applications within 24 hours.

- Receive Funds: Businesses get money to cover payroll expenses.

- Repay Later: Repayment is made when the company receives customer payments.

Note: Payroll funding is not the same as a traditional loan. The money is advanced based on unpaid invoices.

Why Do Businesses Need Payroll Funding?

Many businesses need payroll funding for different reasons:

- Cash Flow Gaps: Delays in customer payments can create cash flow problems.

- Seasonal Expenses: Seasonal businesses may need extra money during busy times.

- Unexpected Costs: Sudden expenses can reduce cash available for payroll.

- Growth Opportunities: Extra cash helps businesses hire more employees and expand.

My friend owns a staffing agency. One month later, several clients delayed their payments, leaving him short on cash. He used a payroll funding company to pay his employees on time. The quick approval and fast funding helped him avoid late payments and keep his employees happy.

Top 4 Best Payroll Funding Companies

1. RTS Financial

RTS Financial is one of the best payroll funding companies, especially for trucking and transportation businesses. With a fast 24-hour approval time and low fees, it helps businesses maintain cash flow without delays. It also provides fuel cards and equipment financing, making it a great option for trucking companies.

A trucking company I know used RTS Financial to cover payroll when customer payments were delayed. The approval process was quick, and the low fees helped the company save money.

2. Factor Funding Co.

Factor Funding Co. is ideal for small businesses and startups that need quick cash to cover payroll. With approval times of 24-48 hours and competitive rates, it offers a balance of speed and affordability. Businesses can use unpaid invoices as collateral, which speeds up the process.

My friend’s small business used Factor Funding Co. to manage payroll during seasonal slowdowns. The competitive rates and quick approval helped them keep employees paid without taking on long-term debt.3. TBS Capital Funding

TBS Capital Funding is known for its same-day approval and transparent pricing, making it a top choice for staffing agencies. By advancing money based on unpaid invoices, it helps staffing companies pay employees on time, even when client payments are delayed.

A staffing agency I worked with used TBS Capital Funding when several clients delayed payments. The same-day approval and clear pricing allowed them to cover payroll without worrying about hidden fees.

3. altLINE

altLINE is a great option for growing businesses that need quick access to cash. With approval times of 1-2 days and low factoring fees, it helps companies cover payroll and invest in growth. Businesses can receive up to $4 million based on unpaid invoices.

A growing e-commerce business I know used altLINE to cover payroll during a period of rapid expansion. The low fees and fast funding helped them hire more employees without cash flow problems.

4. eCapital

eCapital is perfect for seasonal businesses and contractors that need flexible funding. With 24-hour approval and flexible rates, it provides quick cash when businesses need it most. Companies can receive up to $10 million, making it a good choice for both small and large businesses.

A landscaping company I worked with used eCapital to cover payroll during the busy summer season. The flexible rates and quick approval helped them hire more workers without waiting for customer payments.

Choosing the right payroll funding company is important for your business. Here are some factors to consider:

- Approval Speed: Look for companies that approve applications within 24-48 hours.

- Fees and Rates: Compare fees to ensure you get the best deal.

- Customer Service: Choose a company with good customer support.

- Contract Terms: Read the contract carefully to understand repayment terms.

- Reputation: Check online reviews and customer feedback.

When I helped a friend choose a payroll funding company, we compared fees, approval times, and customer reviews. We chose RTS Financial because of its low fees and fast approval. The process was quick and easy, and my friend received the funds within 24 hours.

Comparison of Key Features

| Feature | RTS Financial | Factor Funding | Co.TBS Capital Funding | altLINEeCapital |

|---|---|---|---|---|

| Approval Time | 24 hours | 24-48 hours | Same day | 1-2 days |

| Funding Amount | Up to $5 million | Up to $2 million | Flexible | Up to $4 million |

| Industries Served | Trucking, staffing | Small businesses | Staffing agencies | Growing businesses |

| Customer Service | 24/7 support | Dedicated account rep | Personalized service | Online and phone |

| Best For | Fast cash needs | Startups and small biz | Staffing payroll | Business growth |

| Customer Service | 24/7 support | Flexible support | Best For | Seasonal cash flow |

Benefits of Using Payroll Funding Companies

Using payroll funding companies offers many benefits:

- Fast Access to Cash: Businesses receive funds within 24-48 hours.

- No Long-Term Debt: Funding is based on unpaid invoices, not loans.

- Improved Cash Flow: Helps cover payroll and other expenses during slow periods.

- Flexible Terms: Businesses can choose short-term or long-term funding.

- Focus on Growth: Extra cash allows businesses to hire more employees and expand.

FAQs

What is a payroll funding company?

A payroll funding company provides businesses with short-term cash to cover payroll expenses when cash flow is low.

How quickly can I get payroll funding?

Most companies approve applications within 24-48 hours, with some offering same-day funding.

What fees do payroll funding companies charge?

Fees vary but usually include a percentage of the funded amount. Some companies offer lower rates for larger invoices.

Is payroll funding the same as a loan?

No, payroll funding is an advance based on unpaid invoices, not a traditional loan.

How do I choose the best payroll funding company?

Consider approval speed, fees, customer service, contract terms, and company reputation to find the best fit for your business.

Conclusion

Finding the best payroll funding company can help your business stay on track when cash flow is tight. Payroll funding companies provide quick cash to cover payroll expenses, ensuring employees are paid on time. Choosing the right company depends on factors like approval speed, fees, and customer service. By comparing the top options and their features, you can find the best solution for your business needs.

This post contains affiliate links. I may earn a commission if you make a purchase through them, at no extra cost to you.