Handling payroll can feel like a huge task, especially for a startup. If you’re just starting, the last thing you want is to get bogged down in complicated payroll calculations and tax filings. That’s where the best free payroll software for startups comes in.

These tools can make payroll much easier by automating processes like tax calculations, deductions, and direct deposits. This not only saves you time but also reduces the risk of errors. Whether you’re a solo entrepreneur or have a small team, these free payroll options can help you take care of payroll without the extra cost.

In this post, I’ll walk you through some of the top free payroll software that can simplify your business operations and keep everything running smoothly. Let’s take a closer look at how these tools can help your startup thrive.

Table of Contents

ToggleWhat is Payroll Software?

Payroll software is a tool designed to automate the entire process of paying employees. From calculating wages based on hours worked to deducting taxes, and even generating pay stubs, payroll software makes sure everything is done correctly and on time. It handles the repetitive and complex tasks that come with paying your team, allowing you to focus on other aspects of your business.

For startups, payroll software can be a lifesaver. It ensures compliance with tax laws, reduces the chances of costly mistakes, and helps you manage payroll in a way that’s both efficient and transparent. Whether you’re paying a handful of employees or scaling up your team, using payroll software can save you both time and money.

Why You Need Payroll Software for Your Startup

You might wonder, “Why can’t I do payroll manually?” Well, payroll processing is more than just cutting checks. It involves calculating wages, withholding taxes, filing reports, and ensuring compliance with labour laws. Handling this manually increases the risk of mistakes, leading to penalties, unhappy employees, and wasted time.

Here are a few reasons why you should consider payroll software:

- Save Time: Automation reduces the time spent on payroll calculations.

- Avoid Mistakes: No more manual errors or missed payments.

- Compliance: Payroll software helps you comply with local, state, and federal tax regulations.

- Employee Satisfaction: Employees appreciate on-time, accurate payments.

The Top 5 Free Payroll Software for Startups

Here are the best free payroll software options that can help your startup manage payroll with ease. Each option offers different features, so you can choose the one that suits your needs.

1. Wave Payroll

Best for: Small businesses and startups with a limited budget

Features:

- Free for 1-10 employees: This makes it an excellent choice for startups just starting.

- Automatic Tax Calculations: Wave ensures that your tax calculations are accurate, reducing the chances of errors.

- Direct Deposit: Employees can receive payments directly into their bank accounts.

- Reports: Wave generates detailed payroll reports, which can help you with tax filings and business analysis.

I tried Wave for a small team I worked with, and it was incredibly user-friendly. The process was simple, and the tax calculations were on point, which saved us a lot of stress during tax season. The only downside was that after the first 10 employees, you’d need to pay a fee, but for small teams, it’s great.

Pros:

- Easy to use

- Free for up to 10 employees

- Automated tax calculations

Cons:

- Limited customer support for free users

- Not suitable for large teams

2. PaycheckGuru

Best for: Freelancers and solo entrepreneurs

Features:

- Free payroll for 1-2 employees: If you’re a solo entrepreneur or a freelancer, this software is a fantastic option.

- Simple Interface: The interface is easy to navigate, making it simple for anyone to manage payroll.

- Tax Calculations: The software does a decent job of calculating federal and state taxes, but it’s not as comprehensive as other tools.

I’ve recommended PaycheckGuru to a friend who runs a small startup with just two employees. They loved how easy it was to use, and it did the job well. However, they eventually needed more features as they scaled up, so they upgraded to a paid plan.

Pros:

- Free for up to 2 employees

- Easy-to-use interface

- Accurate tax calculations for small teams

Cons:

- Limited features for growing businesses

- No direct deposit option

3. ZenPayroll (Gusto)

Best for: Growing startups looking for more features

Features:

- Free trial for 30 days: Gusto offers a 30-day free trial, making it a great option for startups looking to test the waters.

- Employee Self-Service: Employees can log in and access pay stubs, tax forms, and other payroll-related information.

- Automated Tax Filing: Gusto takes care of federal and state tax filings, so you don’t have to worry about it.

- Benefits Management: For startups with benefits plans, Gusto can help manage health insurance, retirement plans, and more.

Gusto is a great tool if you’re thinking long-term. I’ve seen several businesses scale up using Gusto. Its ability to handle taxes and benefits makes it worth considering, especially if you plan to expand your team.

Pros:

- 30-day free trial

- Extensive features for tax filings, benefits, and compliance

- Employee self-service

Cons:

- A free version is limited to 30 days

- The paid version may be too expensive for very small startups

4. Payroll4Free

Best for: Startups that need a free solution without fancy features

Features:

- Free for up to 25 employees: Perfect for startups that are growing fast and need to manage payroll without incurring extra costs.

- Manual Tax Filing: Payroll4Free doesn’t handle tax filing automatically, but it gives you the option to generate tax reports for easy manual filing.

- Direct Deposit: Direct deposit is available for employees, making it easy for them to receive their wages.

A friend who runs a fast-growing startup used Payroll4Free for a while. While the service was great for a while, they had to switch to a paid version once their business expanded due to the lack of automatic tax filings. Still, if your team is under 25 people, it’s a solid choice.

Pros:

- Free for up to 25 employees

- Direct deposit available

- Easy-to-use interface

Cons:

- Manual tax filing (you need to do it yourself)

- Limited features compared to paid options

5. SurePayroll

Best for: Startups with more than 10 employees looking for a balance between free and paid options

Features:

- 30-day free trial: SurePayroll gives you a free trial, which lets you explore the software before committing.

- Tax Filing: SurePayroll automatically handles tax filing for federal, state, and local taxes.

- Direct Deposit: Employees can be paid via direct deposit, making it a hassle-free option.

Pros:

- 30-day free trial

- Automatic tax filing

- Great for businesses with more than 10 employees

Cons:

- Paid plans can be expensive for small businesses

- The free trial is limited to 30 days

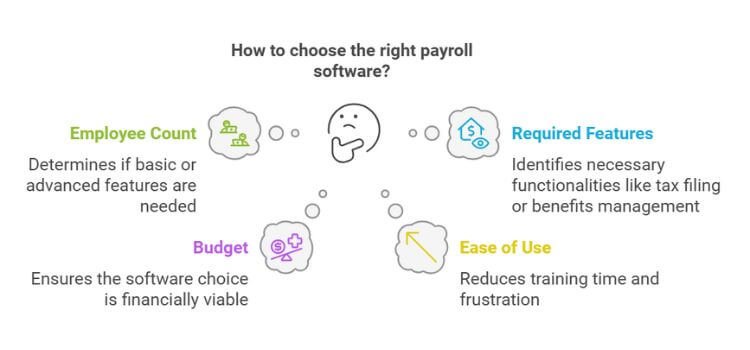

How to Choose the Best Free Payroll Software for Your Startup?

Choosing the right payroll software for your startup depends on several factors. Consider the following questions before making your decision:

- How many employees do I have? – If your team is small, you might not need all the advanced features of paid software. A free solution may be enough.

- What features do I need? – Do you only need basic payroll processing, or do you also need tax filing, employee benefits management, and other payroll-related features?

- What is my budget? – If you’re on a tight budget, look for software that is free for small teams.

- How easy is it to use? – Choose software that is intuitive and doesn’t require extensive training, saving you time and frustration.

By keeping these points in mind, you’ll be able to pick the best payroll software that fits your startup’s specific needs.

Frequently Asked Questions

Is free payroll software reliable for startups?

Yes, many free payroll software options are reliable for small teams or startups. They can automate essential payroll tasks like tax calculations and direct deposits. However, as your business grows, you might need to upgrade to a paid version for more advanced features.

Can free payroll software handle tax filings?

Some free payroll software can handle basic tax calculations and generate reports, but not all offer full tax filing services. If tax filing is a crucial feature for you, make sure the software you choose includes it, even if it’s just for basic federal and state taxes.

How many employees can use free payroll software?

The number of employees that can use free payroll software varies depending on the platform. Some software is free for up to 10 employees, while others may only offer free services for 1-2 employees. Be sure to check the limits before you choose a tool.

Does free payroll software offer direct deposit?

Many free payroll solutions do offer direct deposit, but it’s important to verify the specific features of the software you choose. Direct deposit can save time and improve employee satisfaction by ensuring timely payments.

What happens if my startup grows and I need more features?

As your startup expands, you may need additional features such as employee benefits management or more advanced tax filing tools. Most free payroll software offers paid plans or upgrades that allow you to unlock these features as your business grows.

Conclusion

Managing payroll can be daunting for a startup, but with the right payroll software, you can make the process smooth and efficient. The free payroll software options listed here are a great starting point, offering a range of features to suit small businesses and startups.

If you’re looking for something simple, Wave Payroll and PaycheckGuru are great free choices. For growing businesses, ZenPayroll (Gusto) and SurePayroll offer more advanced features, though they come with a price tag after the free trial.

What do you think? Will one of these payroll solutions work for your startup? I’d love to hear about your experience with payroll software, so feel free to drop a comment below!

This post contains affiliate links. I may earn a commission if you make a purchase through them, at no extra cost to you.